rhi's Benchmarking and Estimating database of performance metrics is derived

from actual project performance information.

rhi's global experience means that we have access to project data via our in-house software, rhiDATA. rhiDATA provides benchmarking and estimating insight and assurance and as a client, you will be informed on value and efficiency relative to similar projects, supported by a range of the most relevant benchmarking metrics.

Benchmarking

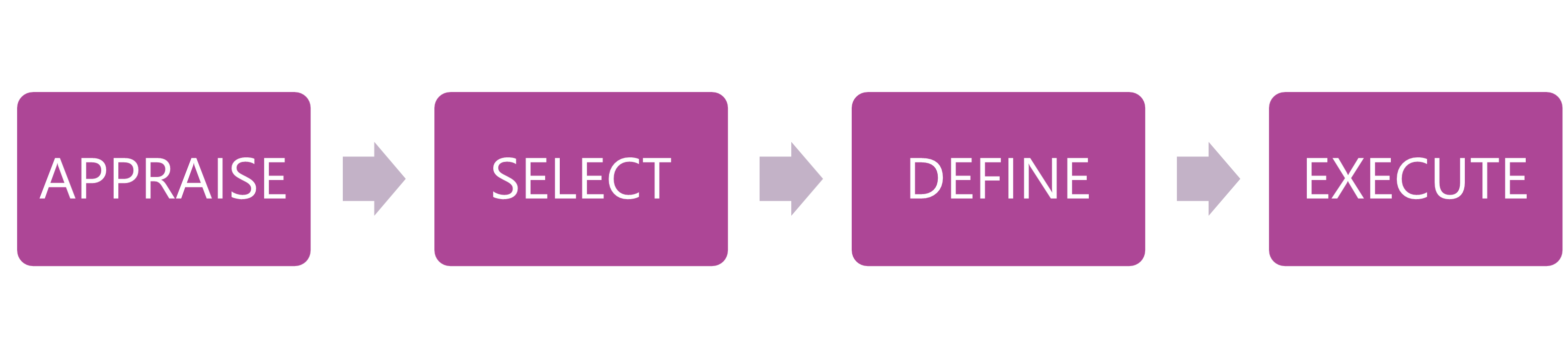

Our benchmarking process is used to provide clients with both project cost and schedule assurance and can be applied at each stage gate throughout the project life cycle; allowing you to make informed decisions at key stages of your project.

Applicable Benchmarks

Key consideration as part of the benchmarking process comprises:

Like-for-Like Project Comparisons

- Project Normalisation including the examples below:

- Location: Labour productivity & Material costs, Transport, Installation

- Processing Complexity, Capacities, Metallurgy

- Water depth, Installation method

Escalation & Inflation

- Escalation: Market-determined, specific to material and/or labour

- Inflation: Increased price of a basket of goods & services

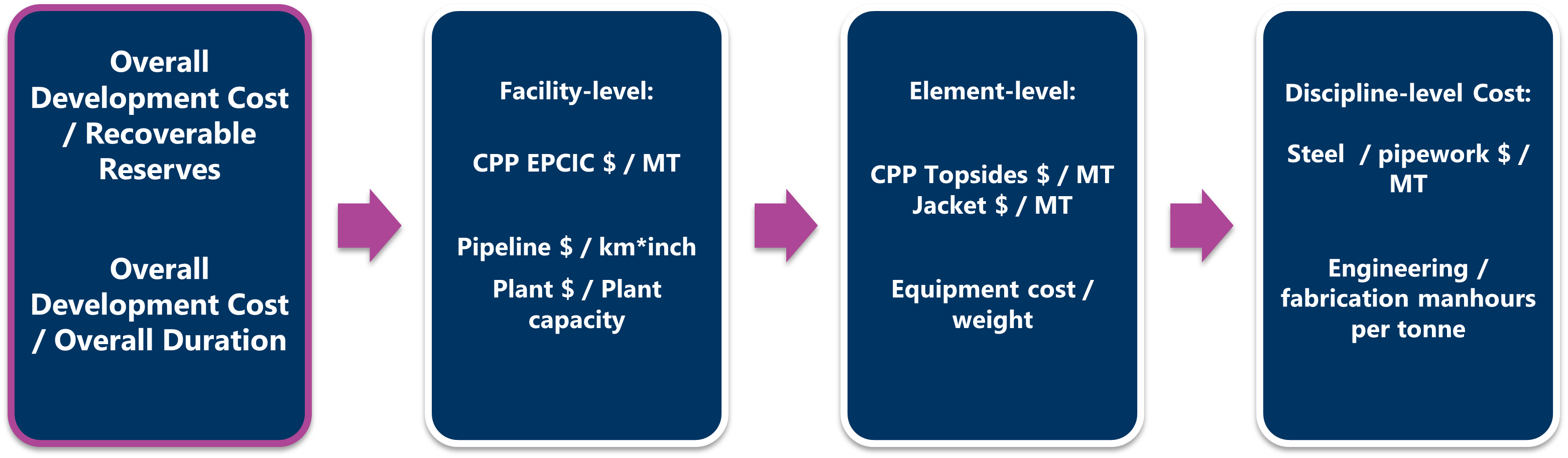

Estimating

We combine our Estimating capabilities with uncertainty and risk analysis to provide a range of solutions for clients’ project evaluations and decision-making. Project teams will have confidence that estimates, and schedules are robust, reflect the most likely outturn and recommended contingency levels which reflect the prevalent uncertainties and risks.

rhi's estimating methodology incorporates building-up a cost estimate from the bottom-up, applying local market derived rates and costs, and comparing the final estimate(s) against established benchmarks.

Our independence of thought and focus on accuracy enables us to add value during reviews and to assure support in every circumstance.

Key services

- Independent estimate/third-party review

- Open Book Estimate (OBE)

- Project capital cost estimate

- Class 1-5 estimates

- Decommissioning estimates

Decommissioning Estimating

rhi has extensive experience in end-of-life decommissioning estimation for both onshore and offshore assets. Through the use of our rhiDEMS tool, our experienced consultants can prepare decommissioning estimates quickly to test a variety of scenarios and strategies interactively and jointly with client teams.

Benefits:

- A standardised format for cost modelling with simplified, template driven input tables that facilitate ease of data entry.

- Industry-wide rates, formally reviewed and updated annually from recent tender data, actual close-out reports, up-to-date market analysis linked to global industry technology advances.

- Separate rates tables that allow ‘plug and play’ estimating for most O&G Regions globally.

- Detailed Norms and Metrics updated and re-calibrated annually from a broad range of project data points.

- Flexible WBS structures that cater for Client specific requirements whilst complying with OGA standards.

- An approach that facilitates running sensitivities and scenarios without the need for lengthy bottoms-up re-building of estimates.

- Standard, common approach with central team to support estimate updates now and in the future.

- Streamlined (annual) ARO update process significantly reduces effort and cost.

- Late Life Operators – validate / confirm ARO provisions; input to cash flow predictions; test alternative methodologies/disposal strategies; test impact of execute schedule on cash flow; identify key cost drivers; test maintenance strategies.

Projects

For more information on where we have used our Benchmarking and Estimating services in client projects, click on the links below:

Field Compression Station Project

Future Growth Project, Kazakhstan

Future Growth Project, Kazakhstan